- United States of Amazon

- Posts

- The People's Republic of Bezos and Zuck

The People's Republic of Bezos and Zuck

Whose interests do Meta and Amazon's growth serve?

This post was originally published in Sherwood News (the media arm of Robinhood) on Monday. Usually when I write a guest column for another outlet, I republish my original “Mikey’s version” draft here to get my most unfiltered and irreverent thoughts in front of you all.

But in this case, I really think the Sherwood team made the piece unequivocally better so I’m publishing exactly as it appeared there with my own cut at a headline. Some bonus commentary on Cannes and the proverbial cocktail recipe follows the piece. I welcome and encourage your banter always at [email protected]

The image Sherwood picked for me. Back to DALL-E next time

For years, the success of the two largest consumer-tech platforms in America — Amazon and Meta — moved in lockstep with the US retail entrepreneurs who relied on their services to grow. But with every passing day, the tech giants’ business has become increasingly decoupled from those US sellers and instead tied to China.

Some US entrepreneurs are struggling on the platforms. Earlier this year, longtime Amazon reporter Jason Del Rey wrote about several sophisticated Amazon sellers who believe their businesses are facing “extinction” because of rising advertising costs and changes to storage-fee structures. Meanwhile, at Meta, direct-to-consumer sellers are experiencing weekslong performance glitches and diminishing returns for ads.

Despite the so-called apocalypse for American start-ups, both Meta and Amazon are notching record profits. A big reason? They’re benefiting from a huge influx of money from Chinese sellers, ranging from behemoths you’ve heard of like Temu to a huge pool of smaller sellers with names like — wait for it — NUTSAAKK.

Chinese firms injected over $7 billion of revenue into Meta in 2023, fueled by the fast rise of Temu, according to analyst Brian Wieser. Temu was the top advertiser by revenue in 2023 for both Meta and Google. While Chinese firms account for only 10% of Facebook and Instagram total ad spend, they’re a huge growth engine: money spent by Chinese entities doubled in a year where Meta overall saw 16% YOY revenue growth.

Just three years after Meta went on a comprehensive product and PR blitz built around American small and midsize businesses, its latest earnings call had only two core themes: AI and increased demand from China.

Meanwhile, Amazon’s latest annual report cites a “significant” dependence on Chinese sellers, estimated by by Marketplace Pulse to account for roughly half of all third-party gross merchandise value and 25% to 30% of total e-commerce on the platform. For all the chatter about Temu in the investor and operator zeitgeist, the revenue generated from Chinese-owned businesses on Amazon with names like DOKOTOO and the aforementioned NUTSAAKK is orders of magnitude bigger.

American shoppers bought roughly $200 billion worth of products from Chinese-owned businesses on Amazon last year. This equates to roughly a net $70 billion that lands in Amazon’s pocket, not counting the money that Chinese brands spent advertising on Amazon. For comparison, the gross merchandise value of transactions on Temu totaled about $15 billion in 2023, with roughly 60% coming from the US.

Momentum Commerce data, as re-envisioned by Sherwood

If you’re looking for proof of concept on where Meta — and even Alphabet’s — advertiser base is headed, look no further than Amazon.

The most under-the-radar big-tech partnership inked in the last year is Amazon and Meta’s deal to integrate Buy With Prime into Facebook and Instagram ads. This partnership opens the floodgates for many Chinese Amazon-native sellers that historically haven’t advertised on Facebook and Instagram to now profitably see traffic from these platforms.

While Temu is now pulling back spending in the US, Chinese-owned commerce writ large is not. The full power of Facebook is about to be unleashed for the long tail of Chinese-owned businesses.

Fuel for investors, a squeeze for US sellers

From a stock-market investor’s perspective, this influx of Chinese brands is myopically good for Amazon, as it will be for Meta. Amazon’s cut of seller fees exceeded 50% for the first time in 2022, and Chinese operations have the gross margins to remain profitable while continuing to invest heavily in Amazon’s wildly lucrative advertising ecosystem.

In a nutshell: when none of the cut is going to an American go-between, Amazon can juice its own take rate on every sale. “Your margin is my opportunity,” Jeff Bezos famously said.

In both Amazon CEO Andy Jassy’s letter to shareholders and Andrew Ross Sorkin’s softball interview that followed, there’s a glib dismissal of the American third-party seller that fueled Amazon’s rise, as if they are now an afterthought.

Jassy comes off as almost purposely obtuse, as if understanding the minutiae of how seller fees work on the platform was a gauche position. This was best exemplified by his consistent emphasis on top-line GMV growth of independent sellers on Amazon and his quip that “sellers are making a lot more money selling on Amazon than they could on their own.” It’s an easy slip to make, but a clumsy one; whether or not sellers truly make money is not a function of their top-line growth, but rather their bottom-line paycheck, which is more squeezed than ever before.

To be sure, the refrain that Meta and Amazon are broadly bad for American small business has been sung since practically the moment these platforms came online. Traditionally, it was a tired and reductionist trope — an attempt to arbitrarily add another populist appeal to the case for regulating big tech. Press darlings Hero Cosmetics, Zesty Paws, Simple Modern, HexClad, and True Classic are but a small fraction of companies that went from nothing to nine figures on the back of the historic hyper-growth opportunity that Meta and Amazon created.

In a sense, both platforms served as the outsourced innovation arm for stagnant American consumer-packaged-goods conglomerates. Brands like Native were spun up by talented entrepreneurs, rapidly scaled on Facebook ads and sold for nine figures in the amount of time it takes a Fortune 500 company to finish a PowerPoint deck.

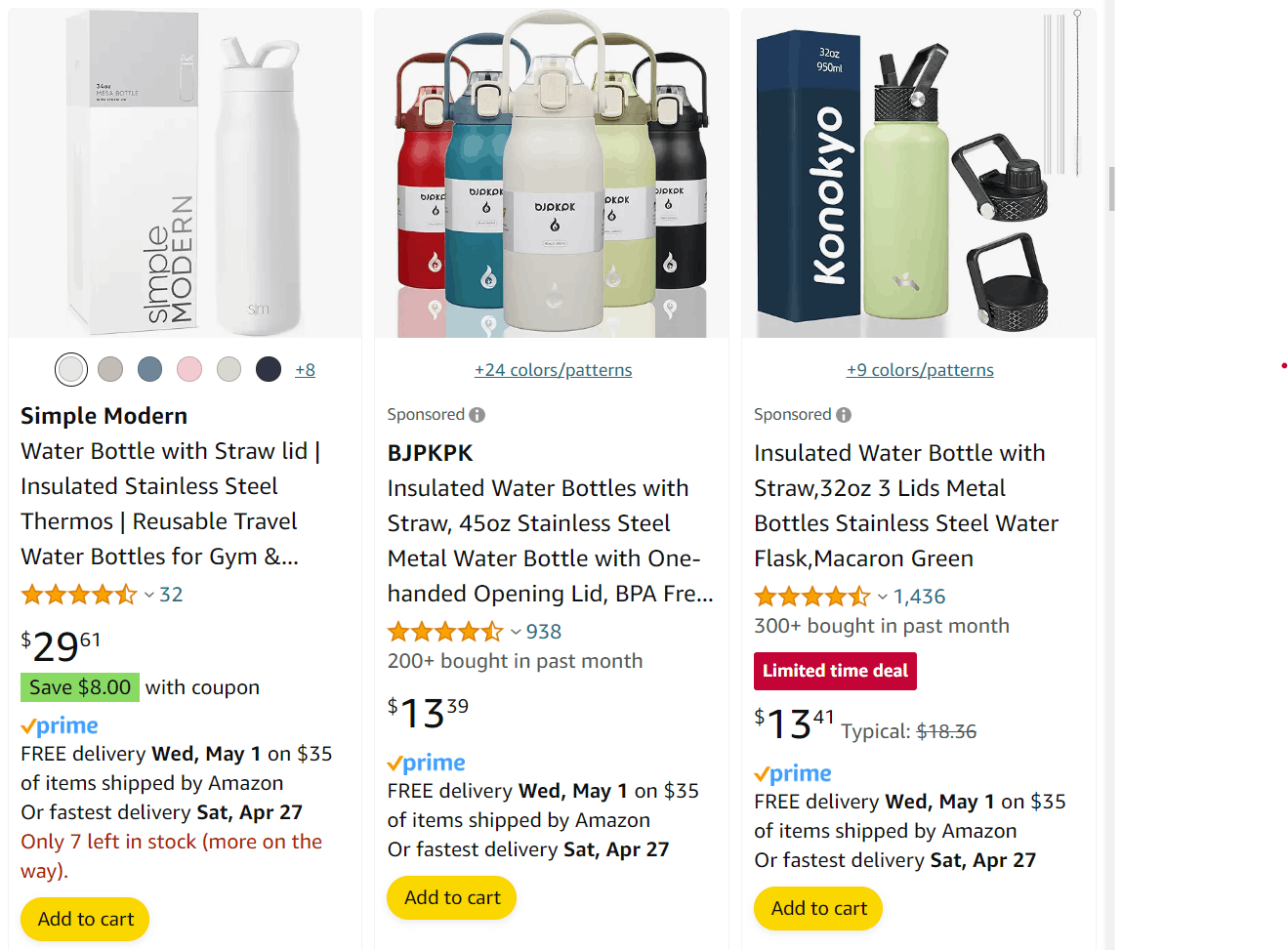

Competitors alongside a Simple Modern water bottle.

You couldn’t profitably build a Zesty Paws from scratch in the US today — the prevailing cost per click of running an Amazon ad for dog supplements has risen roughly 10 times since its launch amid a morass of poorly policed offshore knockoffs, a particularly extreme example of a much larger trend. When I search for a Simple Modern water bottle, for example, I’m inundated with ads for direct-from-China operations with names like BJPKPK or Konokyo, which sell on razor-thin margins at less than half the cost.

Simple Modern can sustain the assault because they’ve spent years building a powerful brand moat. But Chinese brands are rapidly building the same brand-equity firewall, garnering significant brand recall among American shoppers who now seek out their products in search. Whether they build these brands through intricate artistry or just by brute-force flooding the zone with ads is no matter; the end result is the same.

Why should we care?

So if you aren’t an emergent brand that sells products via Amazon or Meta, what does it matter if Chinese firms dominate the platforms? Here, I’d ask two slightly different questions: whom exactly do Meta and Amazon answer to, and whom does their broader growth now serve?

For the everyday American consumer, the net result of Facebook’s algorithms being less effective for DTC brands and Amazon squeezing sellers will be a significant increase in the price of consumer goods sold by American-owned companies. To remain profitable, brands will have to raise prices a lot, outpacing the current rate of inflation. By and large, shoppers may not have much choice but to bear the brunt of this cost if they want to buy from American companies.

This is particularly interesting because FTC Chair Lina Khan’s lawsuit against Amazon is being brought as a pretty conventional antitrust case that, at its core, argues that Amazon’s monopoly power raises prices for consumers. On the surface, Amazon Senior Vice President of Global Public Policy & General Counsel David Zapolsky’s smugly confident response to the complaint seems to parry this well with a grand patriotic through line about how 500,000 independent businesses selling on Amazon creates American jobs and keeps prices low for American consumers. If the government can prove that Amazon’s steadily increasing take rate forces American sellers in particular to raise prices to run sustainable enterprises, Khan can win the case on highly traditional antitrust grounds.

For now, we’re left with a peculiar arrangement. Amazon and Meta stock are among the largest holdings in pension funds, American municipality investments, 401(k)s, and popular ETFs. Tens of millions of Americans depend on Amazon and Meta going up to fund their mortgages, childcare, and retirements. By extension, everyday Americans now have a vested interest in the success of Chinese factory operations over American small business.

In the coming quarters, the most important story in technology and geopolitics will be the degree to which “made, sold, and marketed by China” and the decline in profitable growth for American start-ups prove to be directly causal.

In early 2018, CB Insights ran a poll asking readers which stock was the best bet to buy and hold for 10 years. Alibaba won in a final four that also included Amazon, Apple, and Microsoft. The stock is down more than 60% since. Alibaba never crossed the chasm of selling directly to the American consumer and paid an existential price for it. KWEB, an ETF tracking popular Chinese internet stocks, is down more than 70% from its high-water mark in 2021 as sentiment increases that China, in and of itself as a closed ecosystem, is “uninvestable.”

Suffice to say, Chinese enterprises and the biggest American tech companies need each other to grow. It’s those pesky little American start-ups on the outside looking in.

Amazonia

My quick take on the current thing in the Amazon ecosystem

The Prodigal Son Heads to Cannes: Many of the richer, more successful, and more reverent people in my professional orbit are in Cannes this week while I am not. There’s a lesson there in taking yourself seriously that I’m going to choose to ignore.

Of course, the real Lady Whistledown at this year’s ball is Amazon who has a whole ass port + villa called A’Maison. The incredibly original play on words notwithstanding, A’Maison is really just the Amazon exhibition for the mere commoners. There’s a massive yacht rented for the real big dogs because well…there’s always a bigger boat.

More than anything else, I find it poetic that Amazon is embracing the inanity of Cannes at precisely the same moment that Jeff Bezos has discovered his alter-ego as a true Cuban lothario in Miami. Amazon will be forever shaped in Jeff’s image and if he’s finally gonna live like Pitbull, so too must his firm. They are two parts of the same being.

At some level, I have no problem with any of this. What’s the point of making fuck you money if you ain’t gonna fuck? With the government’s case still over a year away and any notion of antitrust still feeling like a Leviathan that is permanently out to sea, Amazon has won in every sense of the word. But is there any joy in being the victor if you don’t savor the spoils?

However, it’s hard to marry the riviera orgy with the cold realities of the layoffs occurring in many of Amazon’s business units. In particular, a company founded on the principle of customer obsession is slashing down to the bone in its customer experiece organization…..while directors and above get treated to a private Foo Fighters concert.

If everything could ever feel this real forever. If anything could ever be this good again.

Cocktail of the Week: The Guarnaschelli

One of my favorite projects on the internet is Delia Cai’s Hate Read. The concept is exactly as it sounds—each writer gets a soapbox to absolutely rail on the thing they hate most. If Cai ever blesses me with the chance to grace her pages, I have but one submission. I aboslutely hate how the entirety of culinary media in the United States has been subsumed by Alex Guarnaschelli.

Look, I don’t know Guarnaschelli personally— she may well be a wonderful person and my ire here is mostly directed at the Food Network producers. But holy hell, the character that Food Network created is an aboluste affront to the craft of cooking entertainment. Food Network Guranaschelli is like if you trained an LLM exclusively on the Rachael Ray cookbook, taught it to be human by having it shadow the worst PTA mom at your kid’s school and then gave it the charisma of Ron DeSantis. So it gives me no joy to say that her Spiked Earl Grey Lemonade is sublime and should be your drink of the summer.

Simply double the vodka (to cope with drawing inspiration from the most reductionist Food Network crap imaginable) and cut the sugar in half and you’ll be set for any barbecue.

1 cup granulated sugar

9 earl grey tea bags

A fifth of vodka

1 ½ cups lemon juice (about 10 lemons)

One additional lemon sliced thin for garnish

Make your sweet tea, let it cool, add the vodka and lemonade and serve over a lot of ice while lamenting the current state of mass market cable television.

Thanks as always for hanging out. Got a week at the Rockaway Beach Hotel coming up soon so please send me any strong summer beach reads.